Cette page, tout comme le reste du site, est disponible en français

We value the support we get from our taxpayers. We welcome the opportunity to work with taxpayers in the communities within our vast territory to deliver quality bilingual education that Western Québec is committed to provide.

On this page:

- School Taxation 2024-2025

- Property Owner Responsibility

- Electoral List

- Contact the Tax Department

- Transferring a Tax Account

- FAQ – Frequently Asked Questions

For a few years now, invoices calculated by the French school services centre or English school board for a given property produce the same amount payable. Details on the regional tax rate (bill 166).

Answers to Your Questions

You can find information on school taxation on this page. Please take a moment to read it before contacting our tax department. We have prepared a section with our Frequently Asked Questions among which you will find answers to the most frequently asked questions.

School Taxation 2024-2025

The 2024-2025 school tax payment due dates are September 6 and December 5, 2024. This invoicing covers the period of July 1, 2024, to June 30, 2025.

The official taxation rates are standardized and registered in the Gazette du Québec. For the school year 2024-2025, it is at 0.09152% for all school boards and school services centres on our territory, English and French alike.

All accounts in arrears carry an interest rate of 10%.

In an effort to maintain its educational objectives, the Council of Commissioners has mandated the administration to collect all taxes which are in arrears.

You can see how the taxation funds are distributed within the school board’s budget.

Access your School Tax Online

You can easily access your school tax account online, through our Consultation of taxation information and bills tool. Use our TFP guide if you require assistance.

Methods of Payment

There are many ways you can pay your tax bill.

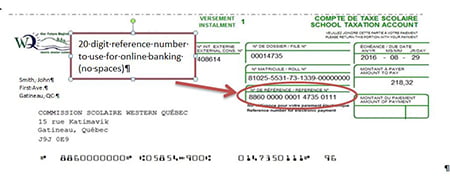

Online – Available through most financial institutions – When doing so, please verify the reference number on your invoice prior to making payment. You will find us registered as Commission scolaire Western Québec or a variation of our name depending on the financial institution (i.e. Comm Scol Western). Please use the 20-digit reference number which appears on your coupon. It begins with ‘886’ and is unique per property. Therefore, we ask that each property is paid separately online. Generally, your payment is received the next business day and will be processed using that effective date.

By Mail – You can pay by sending a cheque payable to “WQSB” or “Western Québec School Board” including the detachable coupon found on your invoice in the return envelope provided.

At the Bank – You can pay at the counter at most financial institutions.

In our Offices – We have a tax counter available in our offices located at 15 Katimavik, Gatineau (QC) J9J 0E9. Our offices are open on weekdays from 8AM to Noon, and from 1PM to 4PM.

Invoice description

Below is a rundown of all the information on your tax invoice.

Municipal roll – Municipal roll values are determined through the municipal or city evaluators and are forwarded to school boards.

Standardization Factor – A Standardization Factor is set by the Minister of Municipal Affairs to provide equity across the province.

Adjusted Value – This one is calculated by multiplying the municipal value with the standardized factor and then staggering the resulting increases.

Neutral Rate – School taxes will be shared on a percentage basis between the English and French school boards if you are a company, organization, association or if you are an individual who has purchased property from a contractor. An individual who has recently obtained property may register change to their future invoice with respect to supporting either the English or the French school board with 100% of their school taxes.

Modifications to the Education Act – In 2007, as a result of significant increases in municipal evaluations and the public’s reactions in regards to the impact on school board taxes, the ministère de l’Éducation et de l’Enseignement supérieur modified the Education Act (LIP – Loi sur l’instruction publique) with Bill 43.

Modifications in summary are the following:

- All increases (or decreases) resulting from new municipal rolls are to be staggered over the period of the roll (i.e. 3 years)

- The option of payments in two instalments when an annual invoice due is calculated to equal $300.00 or higher.

- Removed with Bill 25 as of budget year 2013-2014: A reduction to the current invoice may be calculated per municipality to ensure a limited increase. Article 475.2 LIP dictates this complex calculation. The percent reduction rate is common to both French and English school boards to ensure equity across the shared territory.

Property Owner Responsibility

All owners of taxable property in the province of Québec must pay school taxes. The current Education Act directs school boards in the process of invoice and collection of school taxes. Property owners are responsible for ensuring payment is made. No interest on late payments can be adjusted or removed as prescribed in the Education Act.

The Western Québec School Board deposits by mail the taxation invoice to the property owner. The City or Municipal Regional County forwards the property owner’s address to the school boards for taxation purposes.

There may be a lapse of time in the transfer of new address, or an omission of information, therefore, verification can be made by contacting us.

The school board relies on the address information registered with the MRC or City to contact property owners. A legal recovery process may be deployed on accounts with outstanding balances in absence of a payment arrangement registered in the school board’s database.

Assessment Information / Change of Mailing Address to the MRC

For a change of mailing address, please advise us in writing by completing the following form: Request for change of mailing address. In addition, please contact your city office or MRC.

- Ville de Rouyn-Noranda : 819-797-7111

- M.R.C. Vallée de l’Or : 819-825-7406

- Ville de Senneterre : 819-737-2296

- Ville de Val-d’Or : 819-824-9613

- M.R.C. Témiscamingue : 819-629-2829

- Ville de Gatineau : 819-243-2345

- M.R.C. Vallée de la Gatineau : 819-463-3241

- M.R.C. des Collines : 819-827-0516

- M.R.C. Papineau : 819-427-5138

- M.R.C. Pontiac : 819-648-5689

- Ville de Malartic : 819-757-3611

Find more information on this matter in our tax FAQ.

Electoral List

The law permits an individual to choose on which electoral list he/she would have their name appear. In other words, which school board he /she will exercise his/her right to vote.

Outside of a revision period for elections, one may request, in writing, to the Director General of the School Board that their name be added to the current electoral list.

The school board has prepared a form to facilitate this procedure. Please complete, print and sign, sending original documents to the School Board to the attention of the Secretary General.

Contact the School Tax Customer Service

NOTE – Before contacting our tax team, please note that most of your questions can be answered on this very page, in our FAQ.

Email: taxes@wqsb.qc.ca

Phone: 819-684-2336 option 2

Toll-free within Canada: 1 800 363-9111 option 2

Hours of operation: from Monday to Friday, 8:00 a.m. to 4:00 p.m.

Address: P.O. Box 11818, station D, Montreal, Quebec, H3C 1C6

Alternatively, please complete the following form: Contact the school tax customer service

Find below the answers to our most frequently asked questions.